+-+Black-BabyBlue+(2).gif)

Wednesday, October 13, 2010

Phoenix Area September Home Sales Data

September 2010

RESALE HOME MARKET

Foreclosure activity continued to dominate the resale housing market. With 4,110 recordings, foreclosures accounted for 46 percent of the 9,005 total home recordings for September 2010. This is the highest level of foreclosure activity since 4,370 were recorded in March 2010. The uptick in the resale home activity is not unusual as the traditional selling season comes to an end. For September 2010, there were 9,005 recorded sales, which is a decline from the peak 10,860 sales of March, but slightly above last year’s 9,070 sales.

Foreclosure activity, as percentage of the total resale market, varied throughout the Valley such as 60 percent in El Mirage, 36 percent in Scottsdale and 43 percent in Tempe. Another significant component of the market was the sale of previously foreclosed property, which accounted for approximately 40 percent of the traditional transactions (4,110 sales). Thus, foreclosure–related activity represented 67 percent of the recorded activity.

The biggest issue is heightening uncertainty in the housing market, throughout the country, brought about by the evolving problems within the foreclosure process. The potential impact could encompass moratoriums, availability of title insurance, willingness of people to purchase foreclosed properties and the public perception and acceptance of the entire home financing process. As the year comes to an end, it is not unusual for median home prices to decline from the levels found in resale home buying season. The fundamental reason is sales activity declines in response to holiday and school activities that allow little time or desire to buy a home. In confronting potential uncertainty, the level of activity and prices could even be lower than generally expected as people await the review and resolution of the problems associated with the foreclosure process.

Beyond the impact of foreclosure activity, the absence of a strong move-up market, which is fundamental to a housing recovery, will also limit any growth in home prices. While lower prices can greatly improve affordability, they can adversely impact many owners and potential sellers whom are watching their limited equity erode, as prices decline to and even below existing debt level. The median price for the traditional market in September was $135,000, which is the same as August 2010, but down from last year’s $140,000. The foreclosed properties had a median price of $142,000 in contrast to $147,050 for August and $136,800 for a year ago.

Housing prices are being influenced by foreclosure-related activity. The first influence is that expensive homes continued to be foreclosed, with 18 being over $1 million in September, including 5 above $2 million. Another influence is that, for the last year, approximately 40 percent of the traditional sales were foreclosed homes that were sold again with a median price markdown of 14 percent from the foreclosed price. Although the markdown has improved from 25 percent a year ago, it does vary throughout the Valley ranging from 45 percent in Maryvale to 15 percent in Peoria to 8 percent in the Gilbert area.

Since the Greater Phoenix area is so large, the median price can range significantly. For September 2010 in North

Scottsdale, the median price for a foreclosed property was $353,035 ($323,495 in August) while the traditional market was

$430,000 ($420,000 in August). In South Scottsdale the splits were $175,075 ($184,120 in August) and $159,900 ($164,475

in August), respectively.

In Maryvale, traditional transactions were $47,000 ($49,000 in August) and foreclosures were $73,240 ($78,500 in

August), while in Union Hills it was $192,000 ($192,500 in August) and $165,800 ($174,895 in August), respectively. For

September 2010, Paradise Valley had a median square footage of 5,625 and a median price of $1,465,000.

Within the 1,360 total recorded sales for September 2010, the townhouse/condominium market had 555

foreclosed properties. For a year ago, there were 1,175 total transactions with 410 being foreclosures. In September

2010, the median price for foreclosed properties was $106,860 while the traditional market stood at $75,000. Last year,

the splits were $105,150 and $100,000, respectively.

The median square footage for a single-family home recorded as foreclosed in September 2010 was 1,690 square

feet (1,690 for a year ago), while it was 1,830 square feet (1,795 for a year ago) for a market transaction home. In the

townhouse/condominium sector, the median square footage for a foreclosed unit was 1,100 square feet (1,015 for a year

ago), while the traditional market units was 1,075 square feet (1,120 for a year ago).

Monday, October 4, 2010

Top 10 Real Estate Deals | Scottsdale Greenbelt

TOP 10 REAL ESTATE DEALS

We have analyzed the current marketplace and have selected the Top 10 Properties that offer the Greatest Value at the Best Price.

THIS WEEK'S FOCUS

THE SCOTTSDALE GREENBELT

McCormick Ranch

Gainey Ranch

Scottsdale Country Club

Between $350,000 and $400,000

N. Via Palma

McCormick Ranch

3 bedroom 2 bath

1943 sq. ft.

Patio Home

$350,000

Beautifully Remodeled

Wow! this beautifully remodeled home has it all! Brand new open kitchen with all new cabinets,granite slab counters,a huge breakfast bar, stainless steel upgraded appliances,a wine/beverage fridge,large pantry and under counter lighting! Travertine set on a brick lay and the diagonal throughout except the bedrooms. Designer paint, stacked stone fireplace,upgraded fixtures and lighting and custom cabinetry in the master bath. Travertine showers and granite slab counters in both baths! Two large patios great for entertaining! Beautiful complex features community pools,spas,and tennis courts, plus Mccormick Ranch has miles of biking,walking trails. Walk to restaurants and shopping.No age restriction in Heritage Village two. Seller is in the process of putting final touches on the property.

MLS#4460056 ReMax Fine Properties

E. San Salvador Dr.

McCormick Ranch

3 bedroom 2 bath

1865 sq. ft.

Single Family, Detached

$364,900

Remodeled with Lush Landscaping & Lots of Storage

Beautifully remodeled home in the heart of McCormick Ranch. Nice open Great Room floor plan with plantation shutters throughout, granite counter tops and new kitchen cabinets and fixtures. Side gates, home siding, DE Filter for the pool and pool pump have all been replaced. Current owners have added a soft water system and a Life Source Water Conditioning sytem. Need Storage? Home features lots of attic storage space with 2 points of entrance and a 2.5 car garage. Walking distance to cochise elementary school, greenbelt and Mountain View Park. Backyard features a diving pool and lush landscaping. Great Location!

**When this home is purchased, a portion of the proceeds will be donated to local Arizona Charities through The Williams Community Foundation**

MLS#4433256 The Williams Real Estate Co

E. Gainey Road

Gainey Ranch

2 bedroom 2 bath

1259 sq. ft.

Patio Home

$369,000

Open Floorplan in Gainey Ranch Pavilions

** BEAUTIFUL SINGLE LEVEL HOME IN GAINEY RANCH PAVILIONS ** OPEN FLOOR PLAN ** VAULTED CEILINGS ** FIREPLACE ** LARGE MASTER BEDROOM ** 2-CAR GARAGE ** LARGE PATIO ** SUNSET VIEWS ** CLOSE TO POOL /SPA ** CLOSE TO GAINEY VILLAGE SHOPS AND RESTAURANTS ** LUXURY RESORT STYLE LIVING AT GAINEY RANCH IS THE BEST !! ESTATE CLUB HOUSE ** POOL/SPA ** FITNESS CENTER ** TENNIS COURTS ** GUARD GATED SECURITY ** GOLF AND LAKE COMMUNITY **

MLS#4365179 John Hall & Assoc.

E. Del Marino

Heritage Village

3 bedroom 3 bath

2006 sq. ft.

Patio Home

$375,000

Canterra Style with Casita

Wow!! What an incredible value! Where else in North Scottsdale can you get such an incredible Home with Casita for this kind of price?? This wonderful Golden Heritage home has been maintained beautifully. Features include a private courtyard entry with Canterra Style wall fountain w/Basin, New Paint throughout, Soaring Ceilings, Skylights, Spa Inspired master Bath, New Windows (3 more currently being replaced), Built-In Bookshelves, Newer HVAC, Newer Roof w/Warranty, Epoxy Garage Floor, Garage Cabinets, No Popcorn Ceilings, Full Guest Casita w/Private Bath, Incredible lot siding Greenbelt and no Rear Neighbors, and So Much More! Walking distance to Restaurants, Night Life, Lake, Walking Paths and everything McCormick has to Offer.

MLS#4464411 HomeSmart

N. Ajo Rd.

McCormick Ranch

3 bedroom 2 bath

1942 sq. ft.

Townhouse

$379,900

New. Completely Remodeled.

NEW, NEW. COMPLETELY REMODELED.NOTHING SPARED, NO CORNERS CUT. ALL NEW EVERYTHING!!!!GRANITE COUNTERS,DOORS,FRONT DOOR, KITCHEN, BATHS, CARPET,NEW A/C, FIXTURES, REFRIG, STOVE,WASHER/DRYER. BASE BOARDS, SINKS, TOILETS, LIGHT FIXTURES,CABINETS. THERE IS NOTHING OLD HERE. COMMUNITY HAS JUST COMPLETED ALL NEW ROADS, EXTENSIVE RECLAIMED WATERING SYSTEM HAS JUST BEEN COMPLETED FOR WATERING ALL OF THE GRASS THIS WATER IS SHARED WITH MCCORMICK GOLF COURSE. EXTERIOR OF BUILDINGS ARE IN THE PROCESS OF BEING PAINTED. CENTRALLY LOCATED, PERFECT LOCATION FOR 2ND HOME, CLOSE TO EVERYTHING. NOTING TO DO BUT MOVE IN AND ENJOY!!

MLS#4407568 HomeSmart

N 77th Place

Scottsdale Country Club

2 bedroom 2 bath

1651 sq. ft.

Apartment Style/Flat

$387,000

Luxury Condo in gated community of

Scottsdale Country Club

Luxury 2 bedroom 2 bath condo with den located within the gated golf community of Scottsdale Country Club. Home features two covered balconies, one overlooking the common area with fountain and the other with views of the McDowell Mountains and golf course.

**When this home is purchased, a portion of the proceeds will be donated to local Arizona Charities through The Williams Community Foundation**

MLS#4412870 Williams Real Estate Co

East Benito Drive

McCormick Ranch

2 bedroom 2 bath

1846 sq. ft.

Patio Home

$390,000

Ready to Move In

Special home in a special area of McCormick Ranch. This is a ready to move in home, with newer carpet, floors, appliances, AC/heat pump, granite counters,hugh walkin master shower,new toliets, plantation shutters,new windows and sliding doors, separate laundry room,epoxy floor in the garage, outside of home painted this past winter,outdoor kitchen with beautiful landscaping and a cover patio. The owner has kept this home immaculate even in the garage. Furniture available on separate bill of sale.

MLS#4434150 RE/MAX Achievers

East Ironwood Court

McCormick Ranch

4 bedroom 2 bath

2249 sq. ft.

Single Family Detached

#394,900 just reduced to $379,900

Seller is Motivated...New Low Price

****NEW PRICE REDUCTION SELLER IS VERY MOTIVATED AND WANTS AN OFFER****NOT SHORT SALE OR BANK OWNED Answers fast!!!! HURRY THIS IS THE BEST PRICED HOME IN THE AREA AND WON'T LAST LONG!!!! Great location in Scottsdale close to the 101. Huge corner lot, with 3 car garage. This home has been been recently updated with fresh paint inside and out, wood floors, new blinds, new ceiling fans and light fixtures, brand new appliances, new landscaping, citrus trees, R.V. Gate and much more. If you are looking to live in a quiet community on a culdesac look no further!!

MLS#4431066 Olson Gough

N. Scottsdale Road

McCormick Ranch

3 bedroom 2.5 bath

2293 sq. ft.

Townhouse

$399,000

Vacation in your own Home!

Vacation in your own home! Combine the best of resort living AND receive a return on your investment in the heart of Scottsdale. Join the rental pool where average rents in the high season generate $399 nightly. Set on the edge of McCormick Ranch Golf Course and Lake, this 3 bd/2.5ba is large enough as a getaway for family, friends & foursomes. Furnished & updated in '08, part of the rental pool maintained by the Millennium Resort which offers swimming, tennis, fine dining & other amenities. Fishing, walking and biking trails are at your doorstep. New flooring, granite, designer colors and golf course view from mstr.bd, this home offers the best in AZ living.

MLS#4129213 Russ Lyon Sotheby's

East Via Del Desierto

McCormick Ranch

3 bedroom 2 bath

2046 sq. ft.

Patio Home

$399,000

Step into your fabulous, updated home! On greenbelt,patios,lush landscape.N/S exposure.Living room w/remote operated shades on wood sliding doors.Surround sound,refinshed saltillo tile, wood floors.Second bd has separate entrance to front patio.Kitchen updated 2009 with SS appliances,quartz counter, glass & stone backsplash,amber glass trim.Built in bench under UV coated skylight,gorgeous pantry/cabinet has plug inside for microwave.Skylights in kitchen and eating area.Bathroom custom updated 2008 with 2 shower heads, glass tile, 2 towers on travertine counter, natural stone in brick formation. Upstairs bedroom has view of Camelback from balcony,custom closet system. Pristine neighborhood,clubhouse, heated pool & spa.Exteriors painted 2010. Quiet neighborhood. NOT BANK OWNED OR SHORT SALE

Updated with View of Camelback Mountain from Upstairs Bedroom

**When this home is purchased, a portion of the proceeds will be donated to local Arizona Charities through The Williams Community Foundation**

MLS#4455693 Williams Real Estate Co

Don't Worry...The Market Will Come Back!

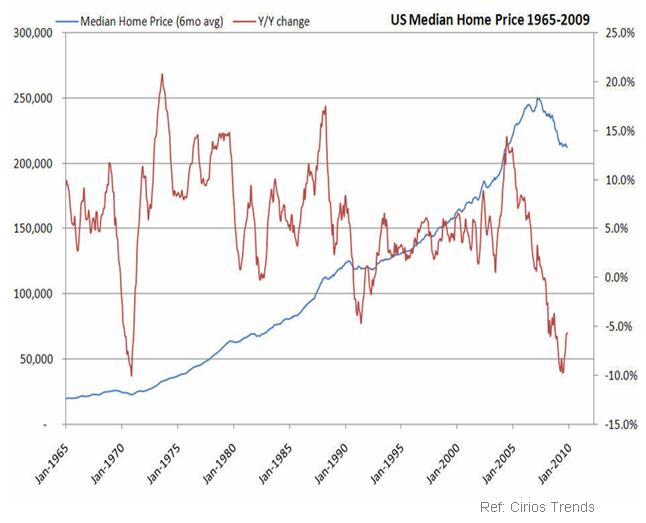

In the last 30 years, although sales of existing homes have gone up and down like a Roller Coaster, prices have increased at a steady pace.

Below is an explanation of when & why prices went up..and then went down....and up again.

1979 - 1982: In October, 1979, Fed Chairman, Paul Volcker, restricted the growth of the money supply, which in turn, caused interest rates to skyrocket.

Interest rates rose from 12.5% (Sept. 1979) to the peak of 17.48% in 1982!

Inflation plagued the economy and unemployment rose from 5.9% in 1979 to 10.8% in December 1982, which put the U.S. in a deep recession. EXISTING HOME SALES DROP 61%!

1982 - 1987: Congress stepped in and deregulated Savings & Loans. This gave them the power to invest directly in service corporations, make real estate loans without regard to the geographical location of the loan, and authorized them to hold up to 40 percent of their assets as commercial real estate loans. REAL ESTATE BOOMS!!!

1988 - 1992: The Savings & Loan Crisis HITS. 747 S&Ls in the United States FAIL. REMEMBER THE "KEATING FIVE"?

President Bush Sr. enacts the S&L Bailout Plan. SOUND FAMILIAR?The ultimate cost of the S&L crisis is estimated to have totaled around $160.1 billion, about $124.6 billion of which was directly paid for by the U.S. taxpayer. SOUND FAMILIAR?

The accompanying slowdown in the Finance Industry and the Real Estate Market may have been a contributing cause of the 1990-1991 economic recession. EXISTING HOME SALES DROP 25%!

1993 - 2000: Interest rates drop, fluctuating from 8.12% in 1993 to 8.32% in 2002. EXISTING HOME SALES ARE ON THE RISE AND PRICES INCREASE AT A STEADY RATE

CAN YOU SAY .COM? Tech Stock becomes KING. Companies see their stock price shoot up when they add .com after their name. Life is GOOD....for a while anyway.

The dot-com bubble burst on March 10, 2000. The crash wiped out $5 trillion in market value of technology companies from March 2000 to October 2000.

2001 - 2007: Enter Alan Greenspan. In an effort to bring us out of a recession after the .com BUST and 9/11, Greenspan dramatically eases credit.

Baby Boomers decide that the stock market won't provide them with sufficient assets to retire. They take advantage of real estate markets and low down payments to speculate in residential real estate.

Investors step in, buy up as much as possible and lie about owners occupying homes.

Buyers overbid because they thought they could FLIP the house and make a killing.

Lenders provide loans to Buyers who could not qualify. THE REAL ESTATE MARKET GOES CRAZY!

HOMES SELL LIKE HOTCAKES AND PRICES ARE DRIVEN UP TO RECORD LEVELS!

It seems that this market will last forever and we will all be rich!

2007 - 2009: Oops! The BUBBLE BURSTS. It had to end, right?

The Bad News: HISTORY REPEATS ITSELF.

The Good News: HISTORY REPEATS ITSELF.

With the DRAMATIC increase in prices from 2001 - 2007, the Market HAD TO correct itself...DRAMATICALLY!

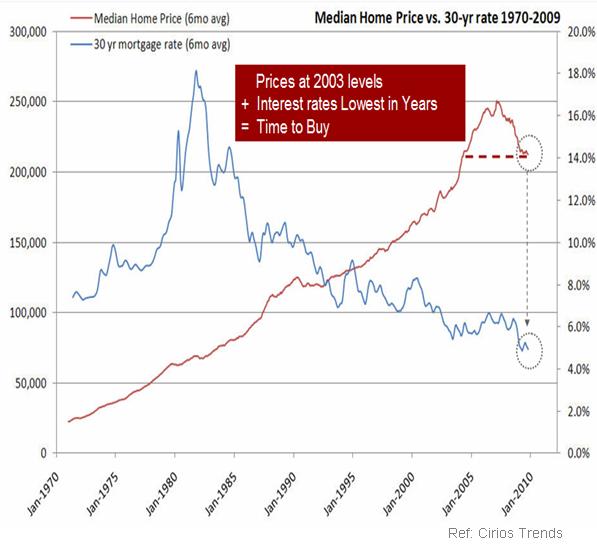

Home prices have rolled back to 2003 levels and as you can see by the chart below, interest rates are still at record lows.

10 Reasons To Buy a Home Enough with the doom and gloom about homeownership.

Brett Arends explains why owning a home is a good thing.

Enough with the doom and gloom about homeownership.

Sure, maybe there's more pain to come in the housing market. But when Time magazine starts running covers that declare "Owning a home may no longer make economic sense," it's time to say:

Enough is enough.

This is what "capitulation" looks like. Everyone has given up. After all, at the peak of the bubble five years ago, Time had a different take. "Home Sweet Home," declared its cover then, as it celebrated the boom and asked: "Will your house make you rich?"

After all, at the peak of the bubble five years ago, Time had a different take. "Home Sweet Home," declared its cover then, as it celebrated the boom and asked: "Will your house make you rich?"

But it's not enough just to be contrarian. So here are 10 reasons why it's good to buy a home.

1. You can get a good deal. Especially if you play hardball. This is a buyer's market. Most of the other buyers have now vanished, as the tax credits on purchases have just expired. We're four to five years into the biggest housing bust in modern history. And prices have come down a long way– about 30% from their peak, according to Standard & Poor's Case-Shiller Index, which tracks home prices in 20 big cities. Yes, it's mixed. New York is only down 20%. Arizona has halved. Will prices fall further? Sure, they could. You'll never catch the bottom. It doesn't really matter so much in the long haul.

Where is fair value? Fund manager Jeremy Grantham at GMO, who predicted the bust with remarkable accuracy, said two years ago that home prices needed to fall another 17% to reach fair value in relation to household incomes. Case-Shiller since then: Down 18%.

2. Mortgages are cheap. You can get a 30-year loan for around 4.3%. What's not to like? These are the lowest rates on record. As recently as two years ago they were about 6.3%. That drop slashes your monthly repayment by a fifth. If inflation picks up, you won't see these mortgage rates again in your lifetime. And if we get deflation, and rates fall further, you can refi.

3. You'll save on taxes. You can deduct the mortgage interest from your income taxes. You can deduct your real estate taxes. And you'll get a tax break on capital gains–if any–when you sell. Sure, you'll need to do your math. You'll only get the income tax break if you itemize your deductions, and many people may be better off taking the standard deduction instead. The breaks are more valuable the more you earn, and the bigger your mortgage. But many people will find that these tax breaks mean owning costs them less, often a lot less, than renting. 4. It'll be yours. You can have the kitchen and bathrooms you want. You can move the walls, build an extension–zoning permitted–or paint everything bright orange. Few landlords are so indulgent; for renters, these types of changes are often impossible. You'll feel better about your own place if you own it than if you rent. Many years ago, when I was working for a political campaign in England, I toured a working-class northern town. Mrs. Thatcher had just begun selling off public housing to the tenants. "You can tell the ones that have been bought," said my local guide. "They've painted the front door. It's the first thing people do when they buy." It was a small sign that said something big.

4. It'll be yours. You can have the kitchen and bathrooms you want. You can move the walls, build an extension–zoning permitted–or paint everything bright orange. Few landlords are so indulgent; for renters, these types of changes are often impossible. You'll feel better about your own place if you own it than if you rent. Many years ago, when I was working for a political campaign in England, I toured a working-class northern town. Mrs. Thatcher had just begun selling off public housing to the tenants. "You can tell the ones that have been bought," said my local guide. "They've painted the front door. It's the first thing people do when they buy." It was a small sign that said something big.

5. You'll get a better home. In many parts of the country it can be really hard to find a good rental. All the best places are sold as condos. Money talks. Once again, this is a case by case issue: In Miami right now there are so many vacant luxury condos that owners will rent them out for a fraction of the cost of owning. But few places are so favored. Generally speaking, if you want the best home in the best neighborhood, you're better off buying.

6. It offers some inflation protection. No, it's not perfect. But studies by Professor Karl "Chip" Case (of Case-Shiller), and others, suggest that over the long-term housing has tended to beat inflation by a couple of percentage points a year. That's valuable inflation insurance, especially if you're young and raising a family and thinking about the next 30 or 40 years. In the recent past, inflation-protected government bonds, or TIPS, offered an easier form of inflation insurance. But yields there have plummeted of late. That also makes homeownership look a little better by contrast.

7. It's risk capital. No, your home isn't the stock market and you shouldn't view it as the way to get rich. But if the economy does surprise us all and start booming, sooner or later real estate prices will head up again, too. One lesson from the last few years is that stocks are incredibly hard for most normal people to own in large quantities–for practical as well as psychological reasons. Equity in a home is another way of linking part of your portfolio to the long-term growth of the economy–if it happens–and still managing to sleep at night.

8. It's forced savings. If you can rent an apartment for $2,000 month instead of buying one for $2,400 a month, renting may make sense. But will you save that $400 for your future? A lot of people won't. Most, I dare say. Once again, you have to do your math, but the part of your mortgage payment that goes to principal repayment isn't a cost. You're just paying yourself by building equity. As a forced monthly saving, it's a good discipline.

9. There is a lot to choose from. There is a glut of homes in most of the country. The National Association of Realtors puts the current inventory at around 4 million homes. That's below last year's peak, but well above typical levels, and enough for about a year's worth of sales. More keeping coming onto the market, too, as the banks slowly unload their inventory of unsold properties. That means great choice, as well as great prices.

10. Sooner or later, the market will clear. Demand and supply will meet. The population is forecast to grow by more than 100 million people over the next 40 years. That means maybe 40 million new households looking for homes. Meanwhile, this housing glut will work itself out. Many of the homes will be bought. But many more will simply be destroyed–either deliberately, or by inaction. This is already happening. Even two years ago, when I toured the housing slump in western Florida, I saw bankrupt condo developments that were fast becoming derelict. And, finally, a lot of the "glut" simply won't matter: It's concentrated in a few areas, like Florida and Nevada. Unless you live there, the glut won't have any long-term impact on housing supply in your town.

Article: http://online.wsj.com/article/SB10001424052748703376504575492023471133674.html

How Does an Interest Rate Affect the Cost of a Home?

That sounds like a simple question.

Of course a lower rate means a lower monthly payment.

But how much of a difference does that really make.

I’ve heard people overly-simplify the issue by saying that a 1% change in rate is roughly the same as a 10% change in price. Let’s look into this a little closer and see if it holds up.

We’ve all heard that interest rates today are at all-time lows. I think we take that for granted, so it helps to include this chart that goes back to 1975.

It shows a 36-year average of mortgage rates.

The BLUE LINE is 30 year fixed rates and since that is the most popular program, that is what we will focus on.

As you can see by the graph, mortgage rates in 2010 are truly lower than anything we have seen in our lifetimes.

Current average 30 year fixed mortgage rates are around 4.375%.

If you were to purchase a home with a $400,000 home loan, the monthly principal and interest payment at that rate would be $1,997.

Now let’s see how raising the rate to the 2000 average of 8.05% affects the payment. That’s not all that long ago.

The payment at same loan amount at the 2000 rate is $2,949.

We increased the rate by 3.675% and that resulted in a 48% increase in payment!

That seems worse than the 1% rate to 10% price ratio, but let’s look at it from a price perspective.

That increase in payment from $1,997 to $2,949 is the same as raising the loan amount from $400,000 to $590,646.

That is also a 48% increase in loan amount.

If the down payment is the same percentage for each example, then it also results in a 48% increase in sales price.

So for this example we discovered that a 3.675% increase in rate equals a 48% increase in price.

It also means a 1% increase in rate is equivalent to a 13% increase in sales price.

Don’t think I chose a year with an exceptionally high rate. I could have used 1981 where rates were 16.63%!

In fact, the average rate over the 36 years is 9%. I chose 2000 because it wasn’t that far back in history.

The lesson here is that we must recognize what an amazing opportunity we have to borrow money at this specific point in history.

Years from now we can look at an updated version of this graph and see the low point, and remember what a great deal we got in 2010.

Why The Largest Percentage Drop In July Was Expected

Why Home Sales Dropped Dramatically in July from June

Or

Why Were We Surprised When Buyers Were Incentivized?

In the week of August 23, blasted throughout the news was existing home sales nationally dropped 27% in July from June.

This was reported as the biggest monthly percentage decline on record.

The Greater Phoenix residential market faired slightly better with a 24% decrease. A large percentage drop in July sales was expected for Greater Phoenix.

Why The Large Percentage Drop for Sales in July Was Expected

Why did sales drop in July?

Because the affect of the tax credit(s) were worn out!

Many buyers bought because of the two tax credits:

The first time homebuyer’s tax credit up to $8,000 and the move up buyer’s tax credit up to $6,500.

To qualify buyers had to be under contract by April 30, 2010 and close by June 30 (at the end of June the close of escrow date was extended to September 30).

The April 30 deadline led to a surge of buyers going under contract in March and April.

So, before you believe the Headlines in the News....look at the statistics...it's not all doom and gloom!

Halos & Handbags | Boys & Girls Clubs | Sammy & Marlys

On Saturday, May 1st, Sammy Glassman and Marlys Lazarus (Mother & Daughter Real Estate Team at The Williams Real Estate Company), joined Lisa Haffner, host of “Your Life A to Z” on KTVK-3TV, and the Boys & Girls Clubs of Greater Scottsdale for a fabulous afternoon of fashion, food, and fun at the 2nd annual Halos & Handbags luncheon and auction at the newly remodeled El Chorro Lodge in Paradise Valley.

From clutches to carryalls, and from vintage to designer, event attendees had the opportunity to bid on more than 100 unique gift items and handbags. They enjoyed a sophisticated afternoon browsing through some of the most stylish handbags available from Coach, Fendi, Kate Spade, and many others.

Halos & Handbags is a celebration of one-of-a-kind vintage clothing and modern accessories with a special fashion show by Fashion by Robert Black – Phoenix fashion icon and former owner of FORD/Robert Black modeling agency.

This event raised more than $40,000 to support children and teens in our community.

Proceeds from Halos & Handbags are invested in the Boys & Girls Clubs of Greater Scottsdale Angels for Kids, Mentors for Life campaign which benefits our more than 16,000 youth members.

Angels for Kids, Mentors for Life helps to support youth development programs for our Club kids and is built around five core areas: the arts, character & leadership development, education & career development, health & life skills, and sports,

fitness & recreation.

With the continued help of Real Estate Agents like Sammy & Marlys, The Boys & Girls Clubs of Greater Scottsdale we can continue to provide a safe, positive place for our youth to go both after-school and during the summer.

ABOUT THE BOYS & GIRLS CLUB - http://www.bgcs.org/

Since 1954, the Boys & Girls Clubs of Greater Scottsdale has provided quality programs to Northeast Valley youth. In that time, more than 100,000 children and teens have been served. Today, more than 16,000 community youth ages 6 to 18 are served through the organization's nine branches and 12 outreach sites located in Scottsdale, Fountain Hills, Salt River Pima-Maricopa Indian Community, Hualapai Indian Community and other Northeast Valley neighborhoods.

The Club offers more than 100 quality after-school and summer programs in a positive, safe, supervised environment. Programs offered at the Club are built around five core areas: the arts, character & leadership development; education & career development; health & life skills; and sports, fitness & recreation.

Supporter Spotlight For The 100 Club of Arizona | Linda Mras

with Linda Mras of

The Williams Real Estate Company

I was first introduced to the 100 Club when my son was training to become a Police Officer. A volunteer spoke on his last day of training at the Police Academy after we had viewed the facility. I remember being ecstatic and proud that my son had decided to become an officer that day and also elated to see how excited he was, however I wasn’t prepared for a presentation by the 100 Club.

As the presenter spoke and I watched the film my happiness was succumbed. As tears rolled down my face, reality set in and I realized the serious commitment that my son had made. He or any of his fellow officers could have their lives taken away in an instant or be injured… then what? Who would help them? Who would help their families?

At the end of the presentation membership forms were passed out for anyone who might be interested in joining the 100 Club. … I knew that our family had to sign up immediately.

2. What has surprised you the most about working with the 100 Club?

The dedication of the staff, volunteers and supporters. I am amazed at how quick they act when the need arises. Also, all of the creative events that they do to raise funds and how thankful they are to the volunteers and contributors.

3. What was the last 100 Club event you volunteered for? And how did that make you feel?

I volunteered for the Gambo and Ash Holiday Hero’s Event that was hosted by KTAR. That day the 100 Club Staff and the volunteers had there adrenaline pumped up which was so exhilarating to me. It felt good to hear the phones ring non-stop in support of our Public Safety Workers. I was so happy to be a part of it.

4. What do you wish other people knew about the 100 Club?

I wished that they knew the 100 Club is a financial first responder for our fallen or injured public safety officers.

5. How else do you support the 100 Club and why?

After becoming a member and then a volunteer I knew that if my son or his fellow officers ever needed assistance that the 100 Club would be there for them. Helping to support the 100 Club through my Real Estate endeavors is my way of giving back.

6. When your friends/family find out that you volunteer at the 100 Club, what do they say or ask?

When I tell my friends and family that I am a member and volunteer of the 100 Club, they usually ask “The 100 Club…what do they do?”. Of course, I always explain and hope that they want to become involved.

7. Tell me about someone who has influenced your decision to work with the 100 Club?

I believe my decision was influenced and finalized by attending the Jason Schechterle Scholarship Ball last Fall and also getting to know all of the amazing people who are a part of the 100 Club.

8. What would you tell someone who is thinking about volunteering or donating to the 100 Club?

Just do it! Your support will have a huge impact.

9. What do you do when you aren’t volunteering for the 100 Club?

Exercise and seek every opportunity that I can to dance the night away to Frank Sinatra tunes.

10. What might someone be surprised to know about you?

I have a passion to find solutions to help others.

Adopt-A-Family | Christmas 2009 | Phoenix Day

You [Davy Yee, Realtor®, The Williams Real Estate Company] and Thuy [Designated Broker, The Williams Real Estate Company] and the rest of the good folks at The Williams Real Estate Company, were instrumental in the success of Phoenix Day’s 2009 Adopt-A- Family Program.

I took over the program in 2005, and at that time we were working with Make-a- Difference, which they are now known as HandsOn Greater Phoenix.

Their role was to get sponsors for the Adopt-a-Family Program and Phoenix Day would sign-up families in need that would benefit from being adopted for the holidays.

It was a wonderful collaboration and year after year we would have their support and many Phoenix Day and HealthLinks families benefited from this program.

Long story short, last year HandsOn told us they were unable to take on this project due to lack of staff and the demands of the project.

So what I turned to the Board Members for their assistance and support in helping me get sponsors for the 69 families that needed help. Needless to say, they were all very supportive and helped by adopting a family or recruiting their family, friends, co-workers to adopt a family.

But Davy, being the amazing person that you are, got your company [The Williams Real Estate Company] involved and hyped up this project!

Thanks to you and The Williams Real Estate Company’s support, 28 families had a wonderful Christmas!”

Bernice Medina

HealthLinks and Case Director

Phoenix Day

At Phoenix Day, we believe that every child, no matter what their socio-economic background, deserves the highest quality early education program. Early childhood education empowers the way children think, learn and behave for the rest of their lives. Established in 1915, Phoenix Day provides a safe, nurturing and diverse environment with age-appropriate curriculum that promotes a lifetime of learning. We welcome you to explore our website and learn more about Arizona's oldest early education and childcare center.

Angels RE Serving our community through Real Estate

The Angels are shining examples of the Philanthropic Realtors at The Williams Real Estate Company. Combining their passion for real estate, sports and community leadership has taken the philanthropic mission to a new level.

One of the Angels, Christina Catalano (Realtor, Triathlete and Community Leader), is a board member for Phoenix Womens Sports Association. Christina and her husband recently participated in Ironman Switzerland, and will be organizing a group of women to run the first Women's Half Marathon in Phoenix.

The Phoenix Women’s Sports Association's mission it is to foster young women in sports, and to honor elite Arizona women Athletes and Award nominees.

The Phoenix Women’s Sports Association's mission it is to foster young women in sports, and to honor elite Arizona women Athletes and Award nominees.Their annual “Game On Event!” an exciting auction night was held at a historic school site, George Washing Carver Museum and Cultural Center with its beautiful historic gym decorated to the hilt as the setting for the event.

Angels RE has three great team members, Natasha Greenhalgh, Jennifer Noelani-Spenser and Christina.

They were fortunate to be a part of the event and invited Dan Williams, President and Founder of The Williams Real Estate Company; Thuy Pham, Designated Broker; and Barbara Bowers, Partner and President of The Williams Community Foundation, to their upbeat and fun annual evening celebration of women in sports who make a difference.

They were fortunate to be a part of the event and invited Dan Williams, President and Founder of The Williams Real Estate Company; Thuy Pham, Designated Broker; and Barbara Bowers, Partner and President of The Williams Community Foundation, to their upbeat and fun annual evening celebration of women in sports who make a difference.The event draws in local Arizona Olympians, Athletes and Physical Education Teachers who have served the Arizona community for their entire careers.

A tribute was paid to each of these outstanding women to acknowledge their impact on the many lives they have touched through sports. Young gals in sports and professional women athletes came together to carry on the integrity and spirit of sports.

The night was filled with a range of community donated auction items related to sports and much more. The “Angels” donated an iPad as the Raffle prize to help raise even more for PWSA. Raffle tickets could be purchased to play golf, throw hoops,… and all for a really great cause. Fundraising goals were exceeded, as well as the expectations of every attendee.

It was a fun, philanthropic evening and they were proud to be a part of the event! “I’ve made it a mission to stay connected with women in sports because it’s such a powerful tool for young women.

It was a fun, philanthropic evening and they were proud to be a part of the event! “I’ve made it a mission to stay connected with women in sports because it’s such a powerful tool for young women.Sports teaches so many good character qualities that continue a lifetime. This supports The Williams Real Estate Company mission of giving back! It is our pleasure to donate a sizable portion of our real estate endeavors back to our community through local charitable organizations.” states Christina Catalano.

It must be working, because Angels RE is one of the most successful real estate teams at The Williams Real Estate Company!